Vote for CFP Energy in the Environmental Market Rankings 2025

Carbon Compliance Markets | Green Certificates

Carbon Compliance Markets | Green Certificates

30 October 2024

Jaclyn Foss

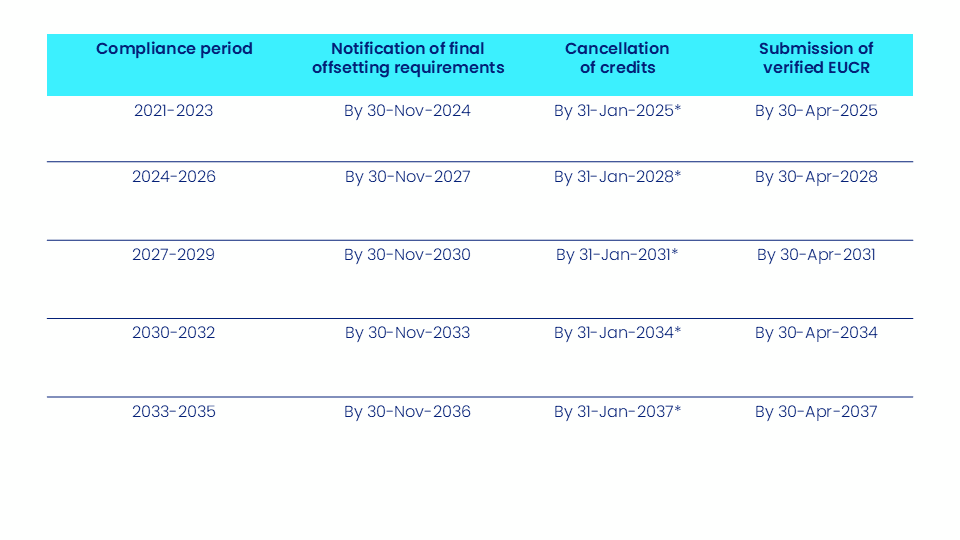

Phase 1, which began in January 2024, aims to stabilise aviation emissions at 85% of 2019 levels, requiring airlines in participating states to offset their portion of emissions growth above this baseline.

Since our initial overview, major updates have emerged, emphasising the need for informed, proactive compliance strategies. Notably, this week, International Civil Aviation Organisation (ICAO) approved Verra, Gold Standard, and Climate Action Reserve (CAR) as eligible standards, marking a pivotal expansion in the pool of carbon credits available.

However, eligibility requirements remain stringent, as credits must come from projects that are registered with an ICAO approved standard, have received a valid Letter of Authorisation (LoA) from the host country, and implement a liability management mechanism (for example insurance) to provide protection against potential Corresponding Adjustment (CA) revocations.

While these new approvals theoretically increase the pool of eligible credits, the practical supply may remain limited due to these requirements, meaning airlines still face potential bottlenecks as they navigate compliance.

The approval of Verra, Gold Standard, and CAR adds diversity to the CORSIA market, adding to the ART-Trees credits that have dominated supply thus far. Credit supply from these standards provides airlines with more options that meet both compliance and environmental integrity requirements.

Margaret Kim, CEO of Gold Standard, described this move as a crucial step towards global decarbonisation, while Verra’s CEO, Mandy Rambharos, emphasised that this approval enables the alignment of these credits with the Paris Agreement's Article 6 framework, enhancing their credibility.

However, these approvals do not fully resolve underlying supply issues. Challenges such as delays in issuing LoAs—commitments from host countries to apply corresponding adjustments (CAs) to carbon credits—continue to limit supply.

CAs prevent double counting by ensuring that emissions reductions or removals represented by credits are not included in the host country’s Nationally Determined Contribution (NDC). The issuance of LoAs remains limited, partly due to ongoing regulatory and digital developments in carbon accounting within many host countries. This could restrict supply and affect credit availability in the CORSIA market.

ICAO’s condition for political liability in the case of potential CA reversals adds additional layers of complexity for supply generation. Verra and Gold Standard, the two major standards in the market, were only conditionally approved in the previous ICAO review due to issues related to allocating liability for credit replacement in the event of a CA revocation.

Insurance solutions have emerged to bridge this gap. Providers such as Oka, Kita and the World Bank’s Multilateral Investment Guarantee Agency (MIGA) have developed products that address CA risks, effectively covering the cost that falls on to the project developer to offer replacement credits in the case of CA revocation.

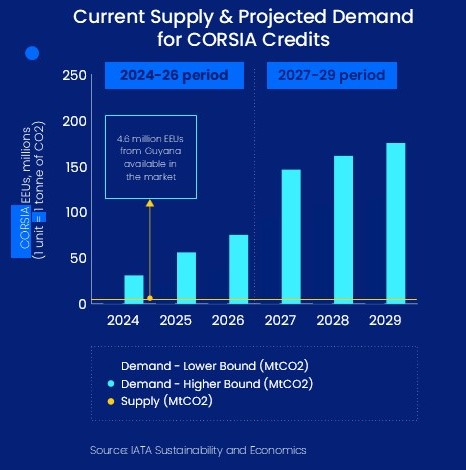

Despite an expanded pool of approved standards, demand could still surpass supply. According to MSCI data, demand for CORSIA-eligible credits in the EU and North American markets has risen.

As CORSIA approaches Phase 2 (2027–2035), which requires compliance across more countries, demand is projected to nearly double. The International Air Transport Association (IATA) has estimated that airlines may need up to 164 million tonnes of CO₂e of offsets over the 2024–2026 period to meet compliance obligations.

To comply with CORSIA, airlines can reduce emissions, procure CORSIA Eligible Emission Units (CEUs), or use Sustainable Aviation Fuel (SAF). However, ongoing challenges in the SAF supply chain and high costs may lead many airlines to relying heavily on offsets, which could further affect market availability.

Challenges in obtaining CA revocation insurance, combined with the complex and slow process of securing Letters of Authorisation (LoAs), may continue to contribute to upward pressure on prices for CORSIA-compliant credits.

As demand continues to grow, a seller’s market could develop, favouring airlines that secure early, multi-year contracts with credit suppliers. Airlines entering the market later in Phase 1 may encounter increased competition and higher prices as credit demand may outstrip available supply.

Airlines can consider several approaches to position themselves effectively in response to evolving compliance requirement.

Early Procurement - Airlines that establish early, multi-year agreements with credit suppliers can mitigate exposure to price volatility and secure access to CORSIA-eligible credits, helping to manage future cost uncertainties.

ESG-Aligned Projects - Some airlines are selecting credits that align with their environmental, social, and governance (ESG) goals. These credits can meet compliance needs while contributing additional social and environmental benefits.

emissions reductions and social benefits, which can enhance brand reputation and resonate with stakeholders. The newly approved standards add more ESG-aligned project options, allowing airlines to meet compliance while contributing positively to communities.

Flexible Contracts and Insurance - In a complex regulatory landscape, flexible credit purchase contracts allow for adjustments as eligibility requirements evolve. Insurance, offered by providers like MIGA, Oka, and Kita, offers protection against CA risks, providing additional confidence amid regulatory uncertainties.

Operational Efficiency and SAF Investment - Airlines are focusing on operational improvements and fleet upgrades to reduce emissions, which can lower their need for offsets. Investment in SAF also supports emissions reduction under CORSIA, decreasing dependency on offsets over time.

With Phase 2 set to expand mandatory compliance across more jurisdictions in 2027, market pressure may increase. ICAO projects a potential rise in compliance costs by over 30% from Phase 1 to Phase 2 as demand grows. This period presents an opportunity for airlines to establish adaptable compliance frameworks.

Airlines might use this time to conduct risk assessments, set up multi-year credit procurement strategies, and explore SAF or SAF certificates to diversify compliance options. By developing resilient compliance frameworks now, airlines can be better positioned to navigate the demands of Phase 2 and manage potential cost increases and market shifts.

In summary, CORSIA Phase 1 will offer valuable insights into the aviation industry’s capacity for compliance under evolving market conditions. Airlines that proactively engage with the market, balancing emissions reduction and offsetting strategies, are better equipped to meet the regulatory requirements of both current and future compliance frameworks.

Proactive planning and a diversified approach may be critical for effective compliance in this increasingly regulated landscape.

Increased government ambition, tighter regulations, greater corporate sustainability commitments, and the outcome of the international COP process will demand serious net zero action from large-scale organisations over the next decade and beyond.

The approval of Article 6 of the Paris Agreement at COP29 in Baku, marks a historic moment for global climate action. Article 6 introduces market-based mechanisms that enable countries to transfer emissions mitigations internationally to meet climate targets. After nine years of negotiations, nations have finalised the frameworks for its two main components, Article 6.2 and 6.4, fully enabling their implementation.

The UK’s newly released Principles for Voluntary Carbon and Nature Market Integrity represent a significant step forward in leveraging voluntary carbon markets (VCMs) to lower global emissions, attract climate finance, and restore nature. These principles reflect a growing international trend toward creating structured, transparent standards for market participation.